OMIP is a Regulated Market operator that provides, together with the OMIClear Clearing House, a trading platform for energy products to the market, as laid down in the International Agreement concluded between the Portuguese Republic and the Kingdom of Spain for the Iberian Electricity Market (MIBEL). As an institution, both OMIP and its activity are supervised by CMVM (the Portuguese Securities Market Commission), in accordance with the applicable national and European laws and regulations of the financial sector.

Under the Derivatives Market, products with electricity and natural gas as underlying assets are open to trading and with delivery in Portugal, Spain, France and Germany (futures, forwards, swaps, options, FTR), that are traded on a daily basis by agents based in Portugal, Spain, and in other European and non-European countries.

In addition to the Derivatives Market, OMIP offers other services, such as development, implementation, management and operation of market solutions in various areas, in particular energy and telecommunications. These services include auctions for allocating assets such as electricity, natural gas, wind energy production licenses, capacities in the Portugal-Spain electricity interconnection, capacities in the infrastructures of the National Natural Gas System, Special Regime Generation, and licenses to use radio spectrum, etc. In the energy retail market, it provides services in the switching of service provider.

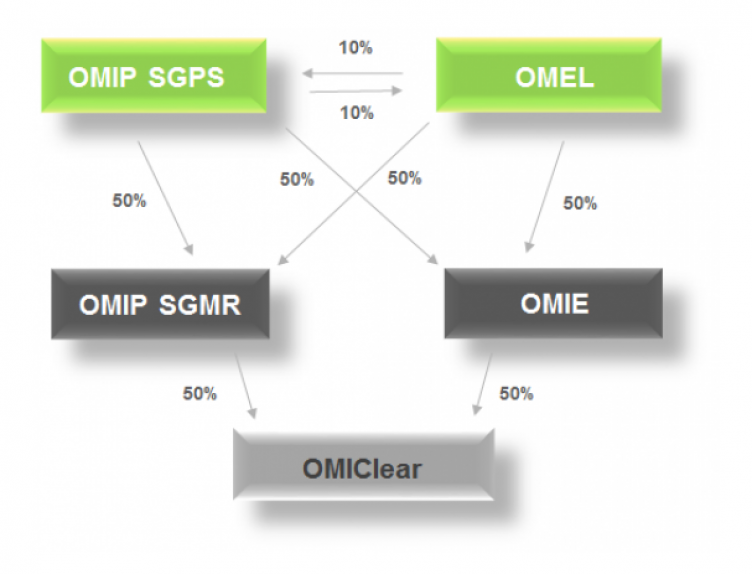

OMIP is part of the OMI Group, which also includes OMIClear, the Iberian Energy Clearing House, and OMIE, Iberian electricity spot market.

OMIClear, C.C., S.A. is a company established in Portugal that provides clearing and settlement services as a Clearing House and Central Counterparty since July 3rd, 2006 of energy derivatives contracts traded and/or registered in OMIP Derivatives Market (the energy regulated market managed by OMIP - Pólo Português, S.G.M.R., S.A.).

In October 31st 2014 OMIClear was approved by its National Competent Authority (CMVM) and the rest of the members of EMIR College to perform the clearing and settlement activity as an ‘authorized CCP’, in compliance with the Regulation (EU) N.º 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, Central Counterparties and Trade Repositories (EMIR – European Market Infrastructure Regulation).